What Is Payroll Withholding . These wages are withheld from an. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. Learn the types of taxes,. — understanding income tax withholding in indonesia. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. — withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted to tax. Stay on top of tax and business reporting in indonesia. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. Simplify your payroll system with. — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. — what is withholding tax?

from www.cpapracticeadvisor.com

— withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. Simplify your payroll system with. Stay on top of tax and business reporting in indonesia. Learn the types of taxes,. — what is withholding tax? These wages are withheld from an. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf.

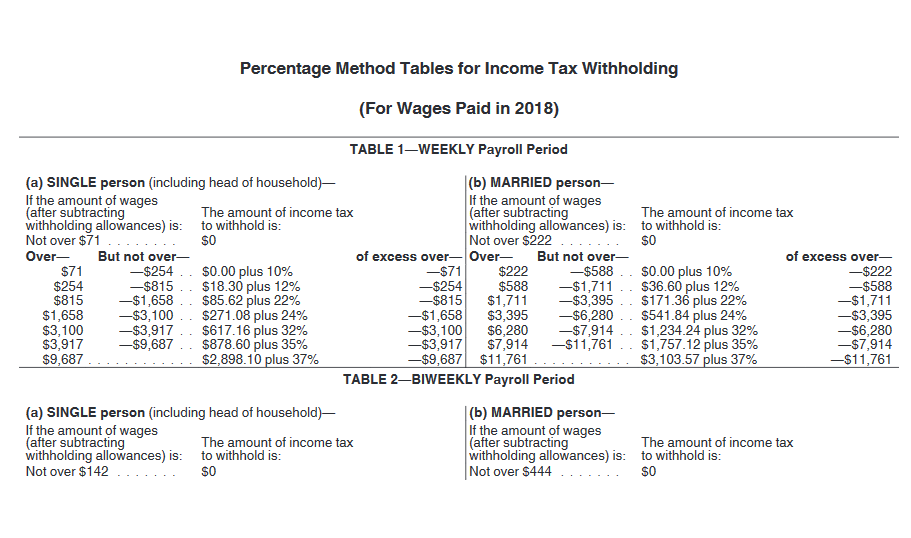

IRS Issues New Payroll Tax Withholding Tables for 2018 CPA Practice

What Is Payroll Withholding Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. — what is withholding tax? — understanding income tax withholding in indonesia. — withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted to tax. Learn the types of taxes,. — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. Stay on top of tax and business reporting in indonesia. — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. Simplify your payroll system with. These wages are withheld from an.

From www.investopedia.com

Withholding Tax Explained Types and How It's Calculated What Is Payroll Withholding — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. Learn the types of taxes,. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Simplify your payroll system with. — withholding is the portion of an employee's wages that. What Is Payroll Withholding.

From www.netsuite.com

Payroll Tax What It Is, How to Calculate It NetSuite What Is Payroll Withholding — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. Learn the types of taxes,. Stay on top of tax and business reporting in indonesia. — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. — payroll tax withholding is when an. What Is Payroll Withholding.

From www.patriotsoftware.com

How to Pay Payroll Taxes Stepbystep Guide for Employers What Is Payroll Withholding — withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted to tax. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. Stay on top of tax and business reporting in indonesia. Learn the types of taxes,. Withholding tax is tax. What Is Payroll Withholding.

From www.cpapracticeadvisor.com

IRS Issues New Payroll Tax Withholding Tables for 2018 CPA Practice What Is Payroll Withholding Simplify your payroll system with. — understanding income tax withholding in indonesia. Learn the types of taxes,. — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. —. What Is Payroll Withholding.

From payroll.utexas.edu

Calculation of Federal Employment Taxes Payroll Services The What Is Payroll Withholding — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. These wages are withheld from an. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. Stay on top of tax and business reporting in indonesia. — payroll withholding. What Is Payroll Withholding.

From www.patriotsoftware.com

The Basics of Payroll Tax Withholding What Is It? What Is Payroll Withholding — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. Learn the types of taxes,. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. These wages are withheld from an. — withholding is the portion of an employee's wages that is. What Is Payroll Withholding.

From www.formsbank.com

Payroll Withholding Authorization Form printable pdf download What Is Payroll Withholding — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. — withholding is the portion of an employee's wages that is not included in their paycheck but is instead. What Is Payroll Withholding.

From www.wrapbook.com

What are Payroll Taxes? An Employer's Guide Wrapbook What Is Payroll Withholding — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. These wages are withheld from an. Stay on top of tax and business reporting in indonesia. — understanding income tax withholding in. What Is Payroll Withholding.

From humanresource.com

Payroll Tax Withholding Everything That You Need to Know Human Resource What Is Payroll Withholding These wages are withheld from an. — what is withholding tax? Stay on top of tax and business reporting in indonesia. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages. What Is Payroll Withholding.

From yhbcpa.com

Have you done a payroll withholding checkup? What Is Payroll Withholding Learn the types of taxes,. Stay on top of tax and business reporting in indonesia. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. These wages are withheld from an.. What Is Payroll Withholding.

From www.checkhq.com

A Brief History of Payroll Withholding in America What Is Payroll Withholding — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. — withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted to tax. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes.. What Is Payroll Withholding.

From www.etsy.com

2022 Weekly Manual Payroll Federal Tax Table Etsy Australia What Is Payroll Withholding Stay on top of tax and business reporting in indonesia. — understanding income tax withholding in indonesia. These wages are withheld from an. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit. What Is Payroll Withholding.

From www.youtube.com

Withholding Taxes How to Calculate Payroll Withholding Tax Using the What Is Payroll Withholding — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck. Stay on top of tax and business reporting in indonesia. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. Simplify your payroll system with. These wages are withheld from an. —. What Is Payroll Withholding.

From tukangdecorkitchensetbakungz.blogspot.com

What Is Payroll? Your Guide To Wages, Taxes, And Benefits What Is Payroll Withholding Simplify your payroll system with. — the irs requires any business with employees to withhold certain taxes from employees’ paychecks, then deposit them with state. These wages are withheld from an. — what is withholding tax? Learn the types of taxes,. — withholding tax is a set amount of income tax that an employer withholds from an. What Is Payroll Withholding.

From elchoroukhost.net

Federal Tax Payroll Withholding Tables 2018 Elcho Table What Is Payroll Withholding Learn the types of taxes,. Stay on top of tax and business reporting in indonesia. — understanding income tax withholding in indonesia. — payroll withholding refers to the process of setting aside a portion of employee wages for taxes. — withholding tax is a set amount of income tax that an employer withholds from an employee’s paycheck.. What Is Payroll Withholding.

From www.alamy.com

Payroll withholding concept icon Stock Vector Image & Art Alamy What Is Payroll Withholding Simplify your payroll system with. — withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted to tax. — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. — payroll withholding refers to the process of setting aside a portion. What Is Payroll Withholding.

From www.superfastcpa.com

Are Payroll Withholding Taxes an Expense or Liability? What Is Payroll Withholding — withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted to tax. Learn the types of taxes,. — payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. Simplify your payroll system with. — withholding tax is a set amount. What Is Payroll Withholding.

From www.pinterest.com

How to Calculate Payroll Taxes Small Business Bookkeeping, Startup What Is Payroll Withholding — withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted to tax. Learn the types of taxes,. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. — payroll tax withholding is when an employer withholds a portion of an. What Is Payroll Withholding.